Wheat market 2023

Wheat Market Briefing - 11 July 2023

Overview

Although the wheat market has retreated from the record highs seen in 2022, the global grain market is highly volatile, being driven by weather in key growing regions and uncertainty around the extension of the agreement facilitating grain exports from Ukrainian ports. Whilst UK feed wheat futures have been creeping downward, nearby quotations for delivered breadmaking wheat remain stubbornly high, reflecting the tight market for quality homegrown wheat owing to the low protein 2022 crop. New crop quotations offer little relief, with the spread between November delivery UK breadmaking over feed wheat futures at record levels, indicating the availability of domestic quality milling wheat could again be low in 2023.

Global supply and demand

Whilst down from the peaks in 2022, the world grain market is currently volatile, with price movements driven by unpredictable weather in key growing regions. Recently, wet weather in the US Midwest has alleviated concerns over drought affecting maize and soyabean crops, with improved yield expectations alongside high area estimates weighing downward on global prices, including wheat. However, rain has not been so forthcoming in much of Europe, with dry weather in France, Germany and Northern Europe leading to a slight downward revision of EU wheat production.

In addition to weather, volatility is being driven by uncertainty around an extension of the Black Sea Initiative, the agreement between Russia and Ukraine to allow safe export of grain from Ukrainian ports. Statements from both Russia and Ukraine have indicated the deal is unlikely to be extended, although the sentiment around an extension varies at short notice as new developments are reported.

UK wheat market

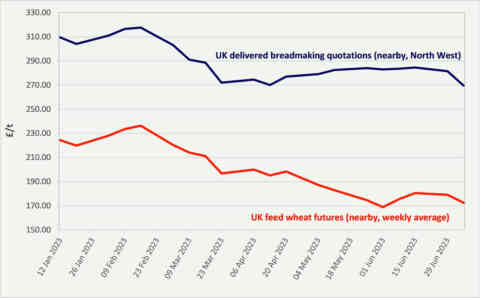

The volatility in global grain markets has affected the UK too, with significant shifts in feed wheat futures seen in recent weeks (Figure 1). Weather has been less of a concern for the UK wheat crop itself, with 76% rated as ‘good’ or ‘excellent’ in the latest AHDB crop development report3. However, yield prospects will still depend on upcoming weather conditions as well as the impact of grass weeds. There have been reports of significant blackgrass infestations affecting wheat crops, particularly in the South East, which could weigh on yields. Disease pressures are also reportedly high this season owing to wet weather during critical growing periods.

UK Milling wheat focus

Supply and demand forecasts for UK milling wheat are a more complicated picture. Despite the volatility in feed wheat futures, quotations for nearby delivered breadmaking wheat (North West) remain stubbornly high (Figure 1). This reflects the tight supply of 2022 crop UK milling wheat meeting quality requirements, with only 36% of Group 1 samples in the AHDB Cereal Quality Survey4 achieving 13.0% protein (the typical quality specification), the lowest in eight years.

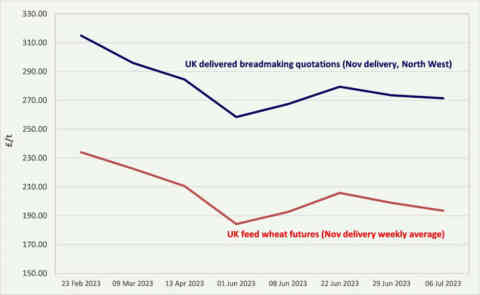

Indications the 2023 UK milling wheat crop could also pose availability challenges are reflected in the record high spread between new crop delivered breadmaking wheat quotations (North West) over new crop feed wheat futures (Figure 2). The latest delivered quotation data from AHDB indicate a spread of £78.00/tonne, almost two times higher than the average over the past five years (£39.15/tonne). This is driven in part by concerns that growers will not apply the additional nitrogen fertiliser needed to achieve 13.0% protein owing to the high cost of this input, which is closely linked to natural gas prices. As we await yield and pass rates, it is likely the spread will closely follow the price of imported German A wheat, the typical replacement for UK breadmaking wheat in seasons with a shortfall.

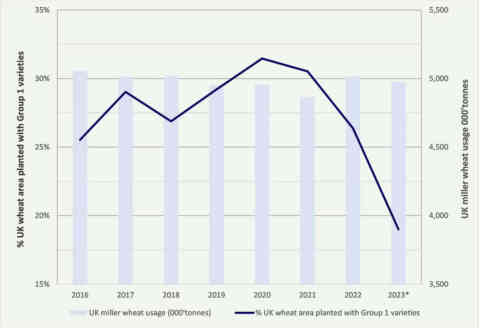

The declining popularity of high protein Group 1 wheat varieties may also be fuelling these supply concerns, with estimates indicating the proportion of the UK wheat area drilled with these varieties is at its lowest (19%) in eight years (Figure 3). This is despite the fact that demand by millers for quality breadmaking wheat remains stable going forward. Considered together, these myriad factors suggest a potentially tight supply and demand landscape for homegrown quality wheat for the upcoming season.

| 5 year average | 2019/20 | 2020/21 |

|---|---|---|---|

| Wheat area (Mha) | 1.802 | 1.816 | 1.387 |

| Yield (t/ha) | 8.4 | 8.9 | 7.0 |

| Production (Mt) | 15.1 | 16.2 | 9.7 |

| Gp 1-3 variety proportion (%) | 41% | 47% | 51% |

| Milling wheat production (Mt) | 6.2 | 7.2 | 4.9 |