Wheat market 2021

Wheat market briefings September 2021

Overview

• Strong global demand for cereals, other bulk commodities and energy, as well as tightness in the UK wheat and haulage markets has led to a range of inflationary pressures.

• Whilst the UK wheat crop is significantly larger than in 2020, prices remain elevated owing to strong domestic demand and global pressures, with quoted September prices for delivered wheat (North West - same month) standing at £229.00/t, £21.50/t higher than equivalent quotation in 2020 (+10%).

• At a global level, weather concerns and strong demand for grains have kept prices high. Severe drought has reduced the prospects for the Canadian spring wheat crop, increasing quotations by 40% year-on-year, with implications for the UK milling market where these wheats are imported to lift flour protein levels.

• Higher freight costs, electricity prices and UK haulage rates, the latter driven by ongoing labour shortages, are also adding significant pressure to the milling sector.

UK wheat harvest 2021

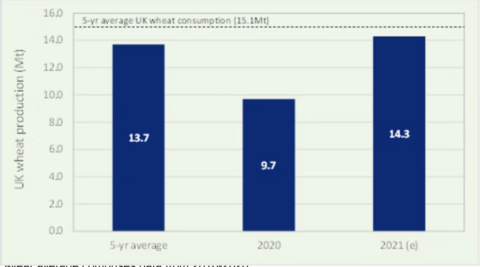

With 90% of the UK wheat crop harvested (as of 07 September), early estimates of its approximate size, based on average yields and area can be made (Figure 1). Whilst there has been a significant rebound in the UK arable area planted with wheat, data from the AHDB harvest reports have pegged the average UK wheat yield as between 8.1-8.3t/ha, slightly higher than the 5-year average of 8.0t/ha. There are some concerns, however, that low specific weights and higher moisture contents may be giving an overestimate of yield figures.

| 5 year average | 2020 | 2021 (e) |

|---|---|---|---|

| Wheat area (Mha) | 1.7 | 1.4 | 1.7 |

| Yield (t/ha) | 8.0 | 7.0 | 8.2 |

| Production (Mt) | 13.7 | 9.7 | 14.3 |

Whilst a production figure of 14.3Mt is 4% above the 5-year average, the carryover stock into the 2021/22 season is very small at 1.2Mt (44% lower than the 5-year average), owing to the poor 2020 wheat crop. This indicates another year of tight supply and demand for UK wheat, despite the significant increase in crop size year-on-year.

Tight wheat market at home and abroad

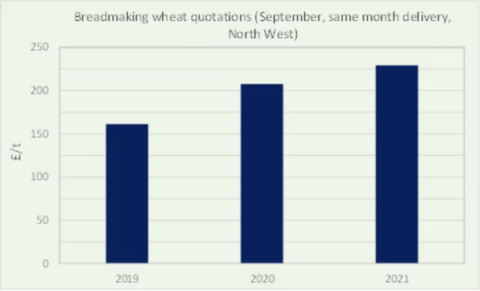

The tight supply and demand landscape is reflected in price quotations for UK wheat in 2021/22 which continue to rise year-on-year. September delivered quotations for breadmaking wheat (North West, same month) stood at £229.00/t, up £21.50/t (+10%) on the equivalent quotation in September 2020, which itself stood £46.50/t on its equivalent quotation in 2019. For millers, the crop quality adds another dimension to availability. Early quality reports indicate a lower protein and lower specific weight year for breadmaking wheat and the market has seen premiums for milling wheat rise standing at between £20-25/t for full specification breadmaking wheat over feed wheat in September. Additionally, lower specific weights reduce flour extraction rates, requiring more wheat to produce the same amount of flour.

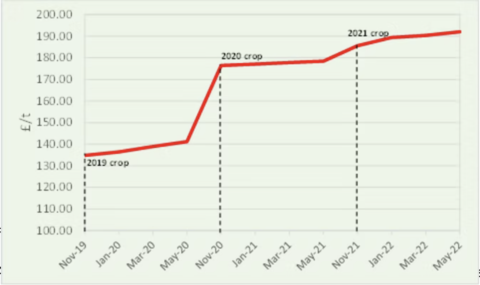

London feed wheat futures (LIFFE) show there is little sign the UK wheat market has been reassured by the rebound in the 2021 domestic crop, likely due to its moderate size, the small carryover stock and with the restart of the Vivergo bioethanol plant, expected strong demand in the 2021/22 season. When looking at monthly futures prices quoted in September each year, it is clear that supply concerns are going to continue into the coming season. For May 2022 delivery, the forward quotation stood at £192.07, higher than any equivalent quotation in the past three years.

As the UK trades cereals on the global market, domestic wheat prices are also affected by global cereal supply and demand. At the global level, maize production estimates are lower than previously expected, owing to weather issues in key production regions and concerns that a La Niña weather event may downgrade South American production forecasts. Likewise, wheat stocks held by major exporters are predicted to be at their lowest levels since 2007/08, with Canadian production estimates at their lowest in 14 years owing to drought damage of spring wheats. The forecasted drop in Canadian wheat production is the greatest since 1988 and is significant for the UK market, as millers import approximately 500kt of high protein Canadian spring wheat each year. The forward cost of Canadian wheat for 2022 is approximately £360/t, an increase of £104.00/t (+41%) on the equivalent quotation the previous year.

Prices have also been affected by higher input costs, with fertiliser prices in 2021 at their highest levels since 2012 owing to increased demand after a year of high grain prices which has led farmers to increase their fertiliser applications. These factors, coupled with strong global demand for cereals, particularly from China, have kept prices elevated.

Energy and transport

In addition to the elevated wheat prices, the cost of energy has risen significantly this year, affecting mill production. Electricity prices have been affected by the rise in global gas prices, which are sitting at their highest level for seven years in real terms owing to a drop in exports of Russian gas. Additionally, low wind output has contributed to rising European electricity prices. Data from Ofgem (Figure 4) show that forward electricity prices have risen 56% in the past six months. The rise in spot electricity prices has been even more significant, increasing by 164% in the from January to July 2021.

The cost of transport has also risen significantly in 2021. An increase in demand for bulk shipping has caused rates to soar since the beginning of 2021. Figure 5 shows the past five years of the Baltic Dry index, which tracks rates for the largest class of bulk transport ships and provides a benchmark for moving raw materials by sea. Since the beginning of January, the index has risen 207%.

The widely reported HGV driver shortage in the UK has affected wheat deliveries as millers must compete more strongly for the limited pool of drivers. A milling industry survey in early September found the rate of wheat delivery failures had doubled and it is expected this will worsen once the sugar beet harvest begins in earnest this autumn. Publicly available data on haulage rates are limited, but in some regions are reportedly up by 150%. For mills sourcing wheat over longer distances, this pressure can be seen in an increase of the premium for milling wheat over feed wheat.

Summary

UK and global wheat prices remain elevated, owing to limited availability and production concerns respectively. Against a backdrop of rising energy costs and haulage rates, the 2021/22 season looks to be challenging, despite a rebound in the UK wheat crop.

Overview - 2 February 2021

- At a global level, wheat remains relatively well supplied, however, a reduced maize supply and potential reductions in soyabean production owing to poor weather has tightened global grain and oilseed balances.

- Government figures peg the 2020 UK wheat crop at 9.7M tonnes, the smallest since 1981 and the greatest year-on-year drop in production since 1892.

- The domestic supply and demand disparity has contributed to the very steep rise in the UK wheat price as the markets switch to an import price basis, but global drivers are also having an effect, with strong demand for soya and maize on the one hand being met with the introduction of Russian export tariffs on the other combining to driving wheat prices sharply higher.

- A poor domestic crop means UK prices face greater exposure to global supply and demand, and price quotations for delivered UK bread wheat stand at £239.00/tonne, up £53.00/tonne (+29%) on the same quotation in February 2020 and representing the highest quotation since 2012. It is also more than £25 per tonne above expectations even in September 2020.

UK supply and demand

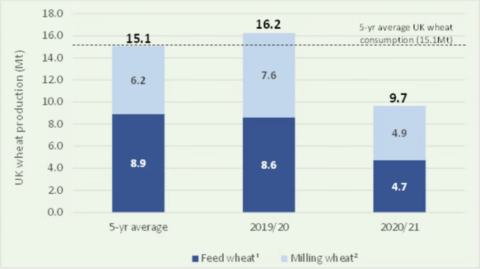

As outlined in the September 2020 UK Flour Millers (then nabim) briefing, the 2020 UK wheat harvest has been exceptionally small owing to poor planting and growing conditions that resulted in a diminished wheat area with low average yields. The finalised Defra production figures peg the 2020 wheat crop at 9.7Mt, a drop of 6.6Mt (-40.5%) on the previous harvest and significantly lower than the 5-year average production of 15.1Mt. In both absolute and percentage terms, this is the largest year-on-year drop in production since records began in 1892.

With a 5-year average UK wheat consumption of 15.1Mt, there is a significant domestic deficit of wheat and increased imports are therefore necessary. HMRC trade data show that UK wheat imports from July to November 2020 were 1.02Mt, 54% higher than the five-year average for July to November (2015-2019) of 0.67Mt.

| 5 year average | 2019/20 | 2020/21 |

|---|---|---|---|

| Wheat area (Mha) | 1.802 | 1.816 | 1.387 |

| Yield (t/ha) | 8.4 | 8.9 | 7.0 |

| Production (Mt) | 15.1 | 16.2 | 9.7 |

| Gp 1-3 variety proportion (%) | 41% | 47% | 51% |

| Milling wheat production (Mt) | 6.2 | 7.2 | 4.9 |

World supply

Despite high global wheat stocks, prices are still supported owing to concerns around soybean and maize supply and demand. The January 2021 USDA supply and demand estimates showed maize and soybean ending stocks are lowered, with US maize ending stocks at their lowest level since 2013/14 owing to reduced yields and a reduction in the harvested area. As maize can be used interchangeably in feed rations instead of wheat, tight stocks of this commodity impact the wheat market and wheat prices rose following the publication of the USDA report on 12th January.

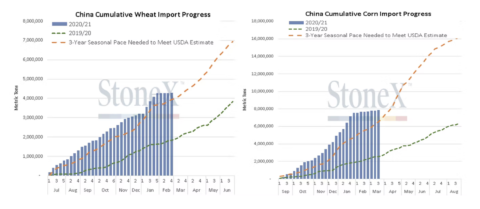

Weather in key maize and soybean growing areas in South America has also impacted the supply and demand picture. Dryness in this major exporting region is likely to reduce production of these crops and as it stands, demand for both maize and soybeans is expected to exceed supply owing to strong demand from China (see Figure 2). A smaller Ukrainian maize crop, a major origin for UK importers, has also contributed to an increase in cereal prices globally and in the UK. The announcement of a wheat export tax in Russia, the world’s largest grain exporter, effective from 15th February, has increased the price of Russian wheat and lent further support to global grain prices. The tax will be introduced over 2 stages and sees wheat charged at €25.00 per tonne rising to €50.00 per tonne on 1st March. Barley and maize exports will also be taxed at €10.00 and €25.00 per tonne respectively.

Wheat market

With the UK at a significant wheat deficit owing to a meagre crop, wheat prices have risen to import parity – the price at which imports are as competitive as domestic origins. As such, global grain prices have a more direct impact on the UK wheat price, which now stands at its highest level in eight years.

Year-on-year, February quoted delivered breadmaking wheat prices (North West) are up £53.00/tonne (29%). From a longer-term perspective, quoted prices of breadmaking wheat are higher than at any point in the past five years (Figure 3). February 2021 same month delivery quotations (North West) stand at £239.00/tonne, £72.30 (43%) higher than the 5-year average for the equivalent quotation across 2016-2020. London feed wheat futures (LIFFE) also give an indication of the scale of the rise of the wheat price, standing at £207.60/tonne (nearby) on 29 January, the highest price since November 2012 (Figure 4).

Importantly, quotations have continued to rise throughout the season. At the beginning of September 2020, the forward quotation for February 2021 delivery stood at £213.50 per tonne, already an elevated level, but £25 less than today’s price for February delivery.

Summary

Global maize and soyabean tightness as well as political intervention affecting wheat imports has driven global cereal prices upwards. With the smallest domestic wheat crop since 1981 and as a significant wheat importer this season, the UK is particularly exposed to global price movements and the domestic wheat price is well above recent averages and the highest it has been since 2012.