Wheat harvest briefings

Wheat harvest briefing - 4 November 2025

Following the publication of the AHDB Cereal Quality Survey on 04 November, this briefing has been updated.

The 2025 UK wheat harvest continues a trend of decreasing production due to depressed yields and a declining wheat area. Low yields in 2025 were primarily due to the exceptionally sunny and dry spring conditions observed across much of the country. More positively, these conditions have delivered good grain quality, and the availability of wheat meeting milling specifications is greater than in seasons with higher levels of total production.

This note and supporting charts provide an overview of key factors:

- Despite a small wheat area and low levels of wheat production in 2024, a significant rebound in UK wheat cultivation in 2025 was not seen, with the estimated wheat area only 1.62Mha1, 6% below the 10-year average of 1.73Mha. This was likely due to the poor crop establishment conditions, as well as the ongoing trend of arable land being taken out of production and entered into environmental schemes.

- The exceptionally dry spring significantly reduced wheat yields, with the average for English farms only 7.0 tonnes per hectare2. This is 13% below the 10-year average of 8.1 tonnes per hectare, highlighting the ongoing challenge posed to UK wheat production by extreme weather.

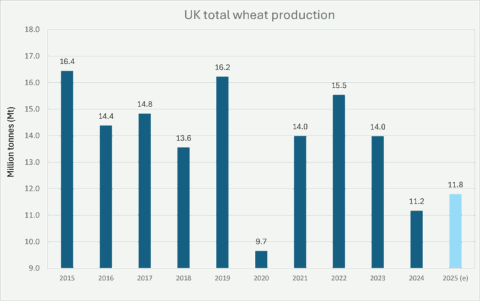

- Total UK wheat production for 2025 is provisionally estimated at 11.8Mt, according to the Agriculture and Horticulture Development Board (AHDB)3. Whilst this provisional figure is a 6% increase on 2024 production, it is 16% below the ten-year average and continues the ongoing decline in UK wheat production (Figure 1).

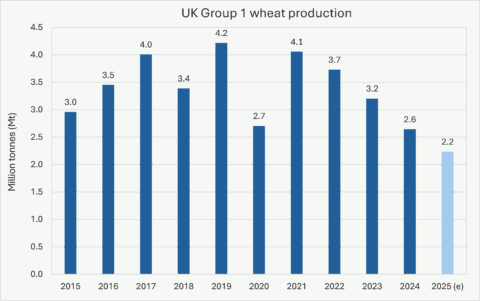

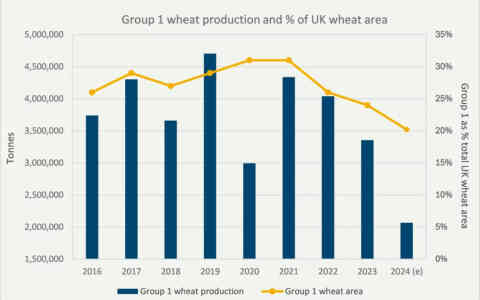

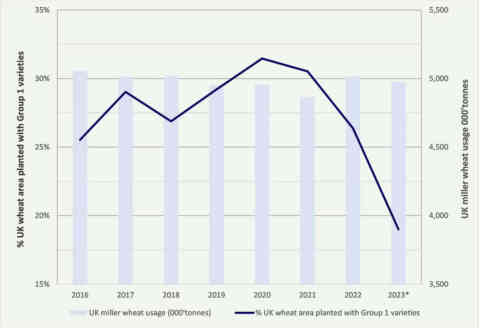

- The share of Group 1 breadmaking wheat varieties, which make up the majority of UK flour miller homegrown wheat usage, is also in decline. For harvest 2025, the AHDB Planting and Variety Survey indicates just 19% of wheat was Group 1 varieties, dropping from 24% in 20241. This gives a total Group 1 production estimate of 2.2Mt tonnes, the lowest level in over ten years (Figure 2).

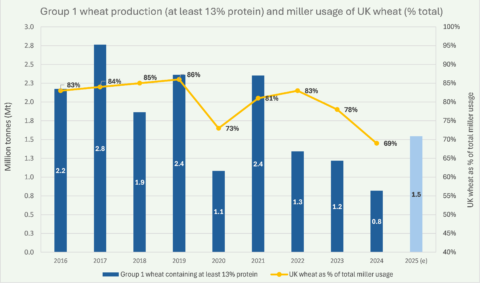

- Although the prolonged dry and sunny weather has reduced UK wheat yields, the impact on wheat quality has been positive. AHDB Cereal Quality Survey data4 show that wheat protein is on average significantly higher than in 2024 and 69% of Group 1 wheat samples contained at least 13% protein. Grain specific weights and Hagberg Falling Numbers, other important features for functional quality, are also good this season.

- Together these data indicate that whilst overall production is lower, the availability of UK wheat that meets milling sector quality requirements is higher. This will likely lead to an increase in milling sector usage of homegrown wheat compared to imports, which has been subdued in recent years due to low availability of high protein UK milling wheat (Figure 3).

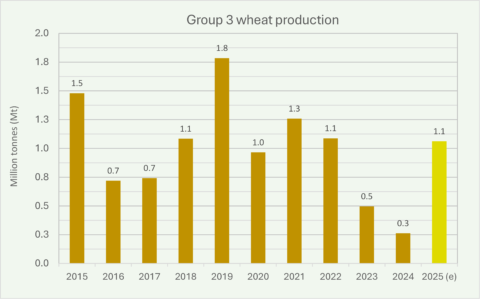

- Another positive development is that Group 3 biscuit wheats have rebounded in popularity1 (Figure 4) due to the launch of new, high-performing varieties, leading to an increase in production.

Figure 1. UK total wheat production in million tonnes. 2025 figure is an estimate.

Data sources: Defra wheat production statistics2 and AHDB provisional 2025 wheat production estimate3.

Figure 2. UK Group 1 wheat production. 2025 is an estimate calculated from total wheat production statistics and the proportion of UK wheat area cropped with Group 1 varieties.

Data sources: AHDB planting and variety survey1, Defra wheat production statistics2 and AHDB provisional 2025 crop estimate3.

Figure 3. Production of Group 1 wheat containing at least 13% protein and milling sector usage of UK wheat as % of total. 2025 production is an estimate based on 2025 production figures and data from the AHDB Cereal Quality Survey. Data sources: AHDB Cereal Quality Survey4 and UK Flour Millers wheat usage survey.

Figure 4. UK Group 3 wheat production estimate, calculated from total wheat production statistics and the proportion of UK wheat area cropped with Group 3 varieties.

Data sources: AHDB planting and variety survey1 and Defra wheat production statistics2.

Wheat harvest briefing - 17 April 2024

Recent news articles have highlighted significant concerns around the prospects for the 2024 UK cereal harvest, with wheat particularly affected by the second wettest August to February since 1837, restricting planting and damaging crop health. The poor outlook for the upcoming wheat harvest is reflected in the market and exacerbates existing concerns around the low availability of milling wheat.

This note and supporting charts provide an overview of the key factors:

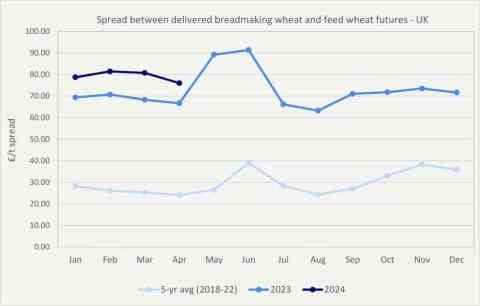

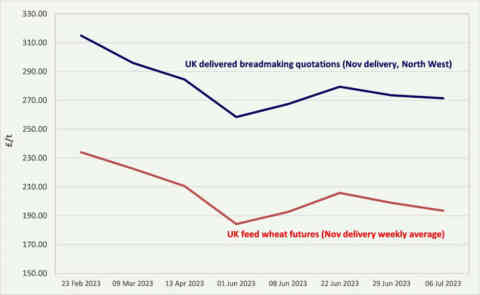

- The availability of homegrown milling wheat has been low for the past two years, with the spread between UK feed wheat and breadmaking wheat over 200% higher than the five-year average for this point in the season (Figure A).

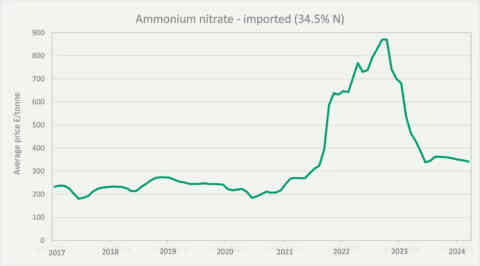

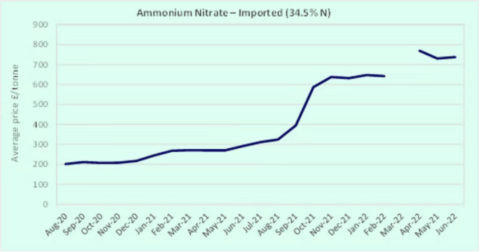

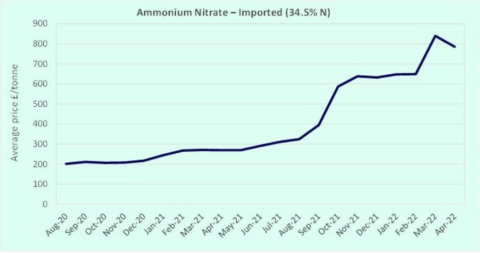

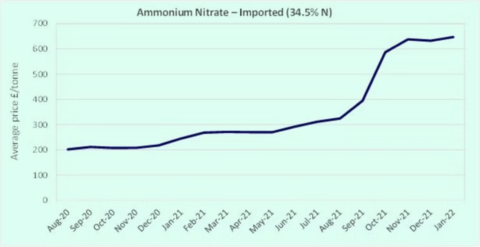

- This is due in part to high input prices affecting the proportion of the crop meeting quality specifications. Prices of nitrogen fertiliser(1) have remained significantly elevated against those prior to the Russian invasion of Ukraine (Figure B), deterring the use of this input which is needed to produce high protein milling wheat.

- Against this backdrop of poor availability, the prolonged wet weather this season has been particularly concerning, preventing a large volume of wheat planting. The AHDB Early Bird Survey(2) indicates the wheat area will be down at least 15% on the previous year at 1.46Mha. This is likely an overestimate as wet weather has continued since the survey was conducted, preventing planting of intended wheat.

- The wet weather has also affected the condition of the wheat crop that farmers were able to plant, with 40% rated as poor or very poor, compared to only 1% rated as such in 2023, according to the AHDB Crop Development Report(3). The prolonged wet conditions have also rendered the wheat crop vulnerable to drought, making weather a key watchpoint for the remainder of the season.

- The low wheat area and poor crop condition, together with the ongoing decline in popularity of milling wheat varieties, estimate the 2024 UK breadmaking wheat crop at only 2.07Mt, 38% smaller than 2023 (Figure C) and lower than any point in the past ten years.

- The dismal crop expectation, particularly for milling wheat, is reflected in the significant spread between new crop breadmaking wheat over feed wheat futures.

- In seasons of poor homegrown breadmaking wheat supply, UK millers use a higher volume of high protein German wheat. However, Germany has faced similar challenges to wheat crop establishment owing to extreme wet weather(4), which could add further pressure to milling wheat availability.

Wheat harvest briefing - 11 July 2023

Overview

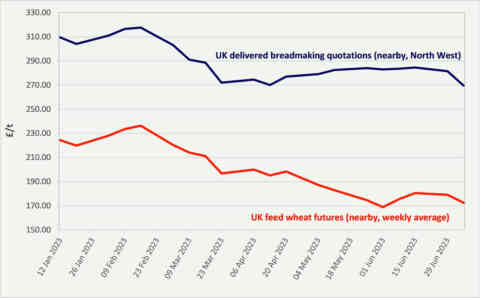

Although the wheat market has retreated from the record highs seen in 2022, the global grain market is highly volatile, being driven by weather in key growing regions and uncertainty around the extension of the agreement facilitating grain exports from Ukrainian ports. Whilst UK feed wheat futures have been creeping downward, nearby quotations for delivered breadmaking wheat remain stubbornly high, reflecting the tight market for quality homegrown wheat owing to the low protein 2022 crop. New crop quotations offer little relief, with the spread between November delivery UK breadmaking over feed wheat futures at record levels, indicating the availability of domestic quality milling wheat could again be low in 2023.

Global supply and demand

Whilst down from the peaks in 2022, the world grain market is currently volatile, with price movements driven by unpredictable weather in key growing regions. Recently, wet weather in the US Midwest has alleviated concerns over drought affecting maize and soyabean crops, with improved yield expectations alongside high area estimates weighing downward on global prices, including wheat. However, rain has not been so forthcoming in much of Europe, with dry weather in France, Germany and Northern Europe leading to a slight downward revision of EU wheat production.

In addition to weather, volatility is being driven by uncertainty around an extension of the Black Sea Initiative, the agreement between Russia and Ukraine to allow safe export of grain from Ukrainian ports. Statements from both Russia and Ukraine have indicated the deal is unlikely to be extended, although the sentiment around an extension varies at short notice as new developments are reported.

UK wheat market

The volatility in global grain markets has affected the UK too, with significant shifts in feed wheat futures seen in recent weeks (Figure 1). Weather has been less of a concern for the UK wheat crop itself, with 76% rated as ‘good’ or ‘excellent’ in the latest AHDB crop development report3. However, yield prospects will still depend on upcoming weather conditions as well as the impact of grass weeds. There have been reports of significant blackgrass infestations affecting wheat crops, particularly in the South East, which could weigh on yields. Disease pressures are also reportedly high this season owing to wet weather during critical growing periods.

UK Milling wheat focus

Supply and demand forecasts for UK milling wheat are a more complicated picture. Despite the volatility in feed wheat futures, quotations for nearby delivered breadmaking wheat (North West) remain stubbornly high (Figure 1). This reflects the tight supply of 2022 crop UK milling wheat meeting quality requirements, with only 36% of Group 1 samples in the AHDB Cereal Quality Survey4 achieving 13.0% protein (the typical quality specification), the lowest in eight years.

Indications the 2023 UK milling wheat crop could also pose availability challenges are reflected in the record high spread between new crop delivered breadmaking wheat quotations (North West) over new crop feed wheat futures (Figure 2). The latest delivered quotation data from AHDB indicate a spread of £78.00/tonne, almost two times higher than the average over the past five years (£39.15/tonne). This is driven in part by concerns that growers will not apply the additional nitrogen fertiliser needed to achieve 13.0% protein owing to the high cost of this input, which is closely linked to natural gas prices. As we await yield and pass rates, it is likely the spread will closely follow the price of imported German A wheat, the typical replacement for UK breadmaking wheat in seasons with a shortfall.

The declining popularity of high protein Group 1 wheat varieties may also be fuelling these supply concerns, with estimates indicating the proportion of the UK wheat area drilled with these varieties is at its lowest (19%) in eight years (Figure 3). This is despite the fact that demand by millers for quality breadmaking wheat remains stable going forward. Considered together, these myriad factors suggest a potentially tight supply and demand landscape for homegrown quality wheat for the upcoming season.

Wheat harvest briefings - Economic update 10 August 2022

- The Russian invasion of Ukraine led to a significant rise in the global grain prices in February / March 2022. The market has since eased back as harvest begins in the Northern hemisphere and there are hopes of grain beginning to move from Ukraine’s Black Sea ports. Nevertheless, wheat prices remain volatile and well above the equivalent level a year ago, with strong premiums for protein whether in the grain or as added gluten. There is some speculation that the EU maize crop will be reduced by the drought, which will result in firmer grain prices. Other input costs, especially energy, remain very high. Both electricity and gas markets are extremely nervous ahead of the winter in face of the threat of Russian refusal to supply gas to Europe. This note and supporting charts provide an overview of the key factors.

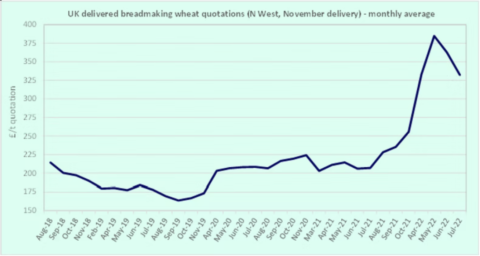

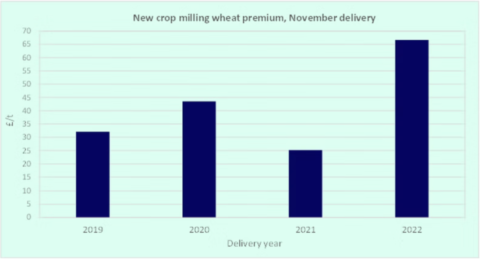

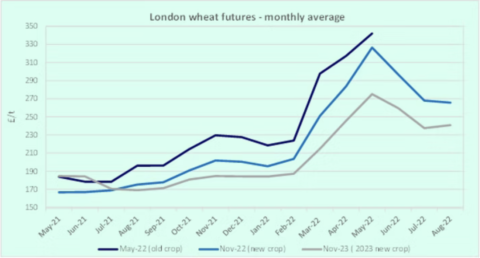

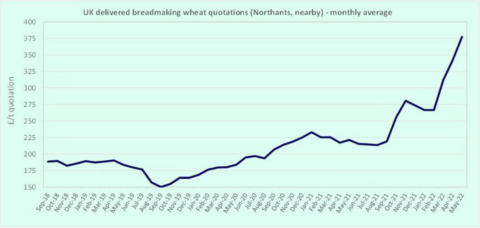

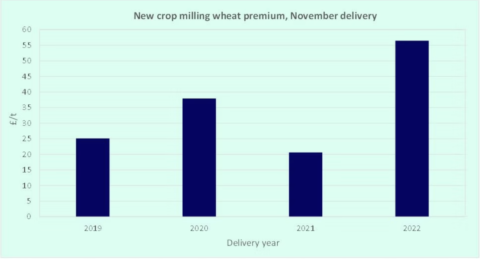

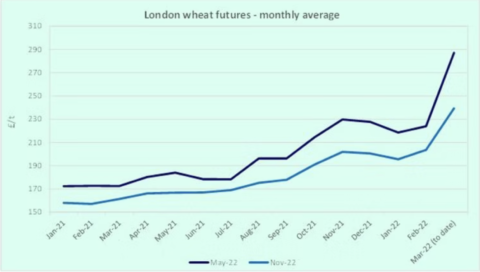

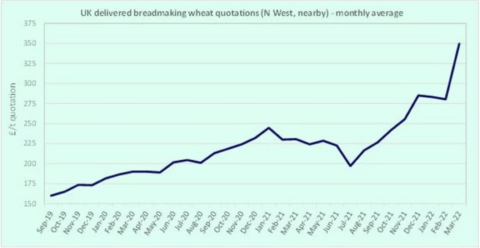

- Although below their peak, grain prices remain very high. The benchmark November delivered price quotation for bread wheat in NW England is £328.50; a year ago it stood at £206.00, an increase of 60% year on year (Figure 1). The milling premium over futures has also opened to over £65 per tonne, compared with £25 a year ago (Figure 2).

- Whilst the war in Ukraine has had a significant price impact as it has disrupted supply and boosted demand in some importing countries as they look to secure food for their people, weather uncertainties have also played a part along with political interventions, such as India’s decision to suspend exports. The premium for higher protein bread wheats over feed (noted above) is a result of lower protein crops in key origins. This has also led to the cost of wheat gluten, which can be added to lower protein wheats in some grists, more than doubling year on year. Alongside quality concerns, the high premium in the UK also reflects the rising cost of haulage.

- Some may have expected the war in Ukraine to cause a short-term impact on wheat prices, however, disruption to Black Sea wheat exports is likely to last for a lengthy period. Although there have been reports of Ukrainian grain leaving via the Black Sea, these have been small in number and appear to be the vessels that have been stuck in ports since February. Coupled with strong global demand, weather concerns and high fertiliser costs, longer-term price pressure is expected and 2023 futures quotations offer only slight relief (Figure 3).

- High nitrogen fertiliser costs, which are closely linked to gas prices, may lead to reduced applications by growers in 2022/23. This is a global trend and raises concerns about both the likely yield of grain in 2023 and the future availability of protein crops – again supporting forward grain prices.

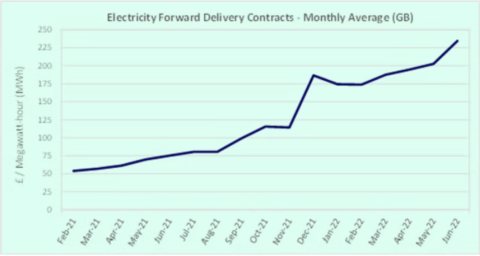

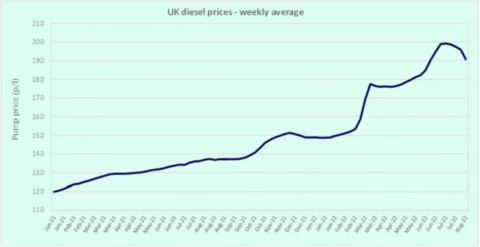

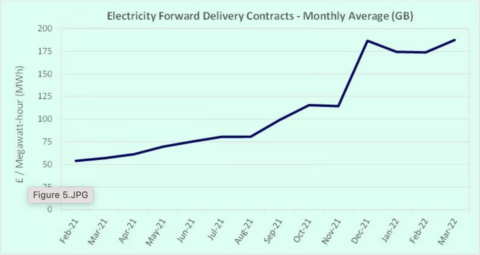

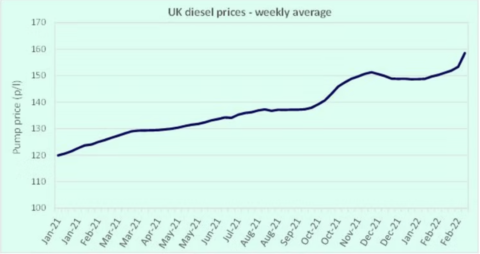

- In addition to wheat, the price of fertiliser (Figure 4), energy (Figure 5) and fuel (Figure 6) remain high and continue to apply significant cost pressure across the food chain. There are also concerns haulage availability will be tight at harvest, as in 2021, particularly when the sugar beet campaign begins. Gas and electricity pricing and availability is also volatile depending on fears of Russia cutting supplies of gas to the EU.

- The new crop price quotations, high fertiliser prices and energy costs highlight that food price inflation is unlikely to be a transient spike owing to the war in Ukraine, but will be a prolonged issue over the coming months. This was well analysed by the Institute for Grocery Distribution in a recent report, which is publicly available at the following link.

Economic update 24 May 2022

Whilst the Russian invasion of Ukraine led to a significant rise in the global grain prices, other factors have continued to push quotations for both old crop and new crop grain to record or near-record highs. This note and supporting charts provide an overview of the factors.

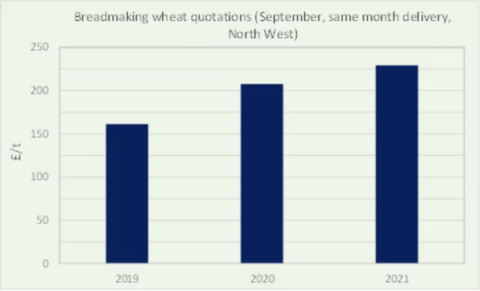

Grain prices are now at record highs, with delivered quotations for breadmaking wheat in all parts of the UK approximately 70% higher than at the previous harvest (September 2021). Figure 1 shows the trend for Northamptonshire; values are even higher in parts of the country further from the main UK wheat supply regions.

- Whilst the war in Ukraine has had a significant price impact, weather concerns in key production regions, in particular drought in the US, have tightened global supply and demand and pushed quotations even higher. The recent announcement by India of a partial wheat export ban has added further price support.

- Some may have expected the war in Ukraine to cause a short-term impact on wheat prices, however, disruption to Black Sea wheat exports is likely to last for a lengthy period. Coupled with the weather concerns for the 2022 wheat harvest and strong global demand, longer-term price pressure is expected and new crop quotations will not provide relief, standing close to old crop with both at record highs. (Figure 2)

- Although a sizeable UK wheat harvest is anticipated, high nitrogen fertiliser prices may lead to reduced applications by growers, which could have a significant impact on UK milling wheat where greater nitrogen applications are needed to achieve the standard breadmaking protein specification of 13.0%. The new crop premium of delivered breadmaking wheat (Northamptonshire) over feed futures reflects these concerns, standing at approximately £56/t, over double the equivalent premium in 2021. (Figure 3)

- In addition to wheat, the price of fertiliser (Figure 4), energy (Figure 5) and fuel (Figure 6) remain high and continue to apply significant cost pressure across the food chain. There are also concerns haulage availability will be tight at harvest, as in 2021, particularly when the sugar beet campaign begins.

- The new crop price quotations, high fertiliser prices and energy costs highlight that food price inflation is unlikely to be a transient spike owing to the war in Ukraine, but will be a prolonged issue driven by weather concerns in key wheat-producing regions coupled with sanctions on Russian trade.

Impact of conflict in Ukraine - Economic update 15 March 2022

This note and supporting charts provides a brief summary of the impact on markets relevant to flour milling and many other parts of the supply chain for grain-based foods.

Pricing

The past weeks leading up to and since the Russian invasion of Ukraine have been tumultuous for grain markets around the world and in the UK. This affects flour millers and other grain users such as animal feed manufacturers.

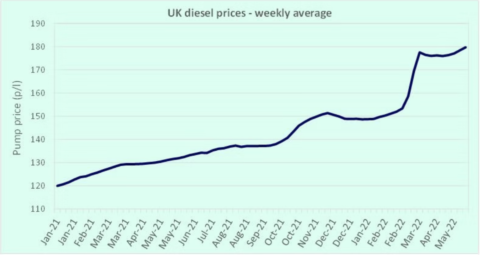

- Wheat prices now stand some 60% higher than they were at the time of the last harvest, in September 2021 (Figures 1.1, 1.2 and 1.3). There is a similar scale of increase in the cost of maize (Figure 1.4) and other ingredients used for animal feed.

- Fertiliser prices are four times higher than they were a year ago, which will affect the cost of production for future crops and will encourage some farmers to reduce usage and therefore future yield (Figure 2).

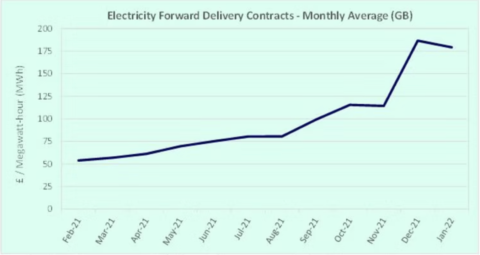

- Energy prices – both oil and gas – have also been driven very much higher, as is obvious to anyone driving. Gas and electricity prices for business are not capped as they are for consumers, meaning that the food chain is already exposed to these increases (Figures 3.1, 3.2 and 3.3).

- 25% of flour is delivered in paper packaging. Costs of paper pulp rose by 50% in the period January 2020 to December 2021 ahead of the conflict. They are likely to be further affected because a proportion of supply normally comes from Russia and is now subject to embargo.

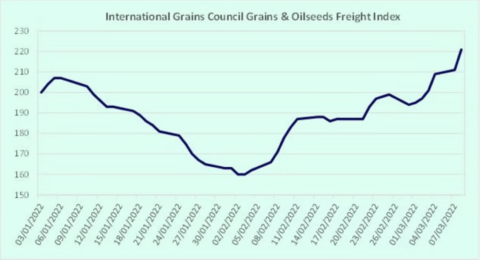

- The cost of freight, having been in decline since the start of the year as coronavirus restrictions eased, has risen by 35% since the beginning of February (Figure 4). Quite a few vessels are effectively trapped in the Black Sea area.

The charts below illustrate the changes in recent months. Although businesses throughout the chain will do all they can to mitigate the impact, these developments will inevitably lead to higher prices for a whole range of products, and the anticipated spike in food price inflation will be higher and last for longer than had been anticipated at the start of 2022.

Supply

The direct impact on UK availability (as distinct from cost) has been limited to specific sectors such as sunflower seed, some organic grain supply chains and to a small extent grain for animal feed. Flour millers source wheat mainly from the UK (85%), Germany and Canada, with only very minor quantities coming from Russia or Ukraine. Therefore, there is no immediate threat to the availability of flour or products with flour as a major ingredient. Nevertheless, with markets very volatile and the reaction of governments unpredictable, careful monitoring of the supply and demand situation is required prior to the next harvest in the summer.

The next grain harvest in the Northern hemisphere is due in June-October 2022. Some spring crops have yet to be planted which means that growers in some parts of Europe, the northern USA and Canada have an opportunity to increase their planted area in response to higher prices. This would help to offset any shortfall in supply next autumn from Ukraine and Russia.

You can download a copy of this briefing note here.

Wheat harvest briefings September 2021

Overview

• Strong global demand for cereals, other bulk commodities and energy, as well as tightness in the UK wheat and haulage markets has led to a range of inflationary pressures.

• Whilst the UK wheat crop is significantly larger than in 2020, prices remain elevated owing to strong domestic demand and global pressures, with quoted September prices for delivered wheat (North West - same month) standing at £229.00/t, £21.50/t higher than equivalent quotation in 2020 (+10%).

• At a global level, weather concerns and strong demand for grains have kept prices high. Severe drought has reduced the prospects for the Canadian spring wheat crop, increasing quotations by 40% year-on-year, with implications for the UK milling market where these wheats are imported to lift flour protein levels.

• Higher freight costs, electricity prices and UK haulage rates, the latter driven by ongoing labour shortages, are also adding significant pressure to the milling sector.

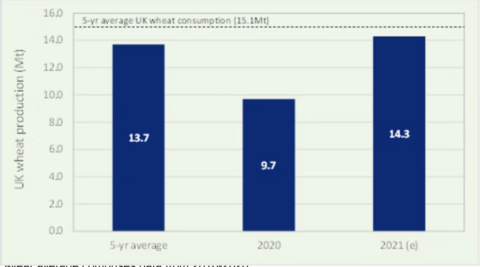

UK wheat harvest 2021

With 90% of the UK wheat crop harvested (as of 07 September), early estimates of its approximate size, based on average yields and area can be made (Figure 1). Whilst there has been a significant rebound in the UK arable area planted with wheat, data from the AHDB harvest reports have pegged the average UK wheat yield as between 8.1-8.3t/ha, slightly higher than the 5-year average of 8.0t/ha. There are some concerns, however, that low specific weights and higher moisture contents may be giving an overestimate of yield figures.

| 5 year average | 2020 | 2021 (e) |

|---|---|---|---|

| Wheat area (Mha) | 1.7 | 1.4 | 1.7 |

| Yield (t/ha) | 8.0 | 7.0 | 8.2 |

| Production (Mt) | 13.7 | 9.7 | 14.3 |

Whilst a production figure of 14.3Mt is 4% above the 5-year average, the carryover stock into the 2021/22 season is very small at 1.2Mt (44% lower than the 5-year average), owing to the poor 2020 wheat crop. This indicates another year of tight supply and demand for UK wheat, despite the significant increase in crop size year-on-year.

Tight wheat market at home and abroad

The tight supply and demand landscape is reflected in price quotations for UK wheat in 2021/22 which continue to rise year-on-year. September delivered quotations for breadmaking wheat (North West, same month) stood at £229.00/t, up £21.50/t (+10%) on the equivalent quotation in September 2020, which itself stood £46.50/t on its equivalent quotation in 2019. For millers, the crop quality adds another dimension to availability. Early quality reports indicate a lower protein and lower specific weight year for breadmaking wheat and the market has seen premiums for milling wheat rise standing at between £20-25/t for full specification breadmaking wheat over feed wheat in September. Additionally, lower specific weights reduce flour extraction rates, requiring more wheat to produce the same amount of flour.

London feed wheat futures (LIFFE) show there is little sign the UK wheat market has been reassured by the rebound in the 2021 domestic crop, likely due to its moderate size, the small carryover stock and with the restart of the Vivergo bioethanol plant, expected strong demand in the 2021/22 season. When looking at monthly futures prices quoted in September each year, it is clear that supply concerns are going to continue into the coming season. For May 2022 delivery, the forward quotation stood at £192.07, higher than any equivalent quotation in the past three years.

As the UK trades cereals on the global market, domestic wheat prices are also affected by global cereal supply and demand. At the global level, maize production estimates are lower than previously expected, owing to weather issues in key production regions and concerns that a La Niña weather event may downgrade South American production forecasts. Likewise, wheat stocks held by major exporters are predicted to be at their lowest levels since 2007/08, with Canadian production estimates at their lowest in 14 years owing to drought damage of spring wheats. The forecasted drop in Canadian wheat production is the greatest since 1988 and is significant for the UK market, as millers import approximately 500kt of high protein Canadian spring wheat each year. The forward cost of Canadian wheat for 2022 is approximately £360/t, an increase of £104.00/t (+41%) on the equivalent quotation the previous year.

Prices have also been affected by higher input costs, with fertiliser prices in 2021 at their highest levels since 2012 owing to increased demand after a year of high grain prices which has led farmers to increase their fertiliser applications. These factors, coupled with strong global demand for cereals, particularly from China, have kept prices elevated.

Energy and transport

In addition to the elevated wheat prices, the cost of energy has risen significantly this year, affecting mill production. Electricity prices have been affected by the rise in global gas prices, which are sitting at their highest level for seven years in real terms owing to a drop in exports of Russian gas. Additionally, low wind output has contributed to rising European electricity prices. Data from Ofgem (Figure 4) show that forward electricity prices have risen 56% in the past six months. The rise in spot electricity prices has been even more significant, increasing by 164% in the from January to July 2021.

The cost of transport has also risen significantly in 2021. An increase in demand for bulk shipping has caused rates to soar since the beginning of 2021. Figure 5 shows the past five years of the Baltic Dry index, which tracks rates for the largest class of bulk transport ships and provides a benchmark for moving raw materials by sea. Since the beginning of January, the index has risen 207%.

The widely reported HGV driver shortage in the UK has affected wheat deliveries as millers must compete more strongly for the limited pool of drivers. A milling industry survey in early September found the rate of wheat delivery failures had doubled and it is expected this will worsen once the sugar beet harvest begins in earnest this autumn. Publicly available data on haulage rates are limited, but in some regions are reportedly up by 150%. For mills sourcing wheat over longer distances, this pressure can be seen in an increase of the premium for milling wheat over feed wheat.

Summary

UK and global wheat prices remain elevated, owing to limited availability and production concerns respectively. Against a backdrop of rising energy costs and haulage rates, the 2021/22 season looks to be challenging, despite a rebound in the UK wheat crop.

Overview - 2 February 2021

- At a global level, wheat remains relatively well supplied, however, a reduced maize supply and potential reductions in soyabean production owing to poor weather has tightened global grain and oilseed balances.

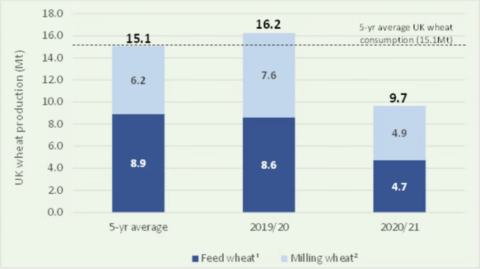

- Government figures peg the 2020 UK wheat crop at 9.7M tonnes, the smallest since 1981 and the greatest year-on-year drop in production since 1892.

- The domestic supply and demand disparity has contributed to the very steep rise in the UK wheat price as the markets switch to an import price basis, but global drivers are also having an effect, with strong demand for soya and maize on the one hand being met with the introduction of Russian export tariffs on the other combining to driving wheat prices sharply higher.

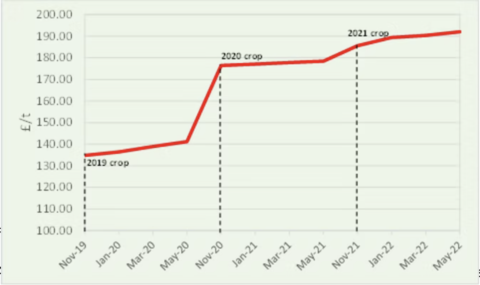

- A poor domestic crop means UK prices face greater exposure to global supply and demand, and price quotations for delivered UK bread wheat stand at £239.00/tonne, up £53.00/tonne (+29%) on the same quotation in February 2020 and representing the highest quotation since 2012. It is also more than £25 per tonne above expectations even in September 2020.

UK supply and demand

As outlined in the September 2020 UK Flour Millers (then nabim) briefing, the 2020 UK wheat harvest has been exceptionally small owing to poor planting and growing conditions that resulted in a diminished wheat area with low average yields. The finalised Defra production figures peg the 2020 wheat crop at 9.7Mt, a drop of 6.6Mt (-40.5%) on the previous harvest and significantly lower than the 5-year average production of 15.1Mt. In both absolute and percentage terms, this is the largest year-on-year drop in production since records began in 1892.

With a 5-year average UK wheat consumption of 15.1Mt, there is a significant domestic deficit of wheat and increased imports are therefore necessary. HMRC trade data show that UK wheat imports from July to November 2020 were 1.02Mt, 54% higher than the five-year average for July to November (2015-2019) of 0.67Mt.

| 5 year average | 2019/20 | 2020/21 |

|---|---|---|---|

| Wheat area (Mha) | 1.802 | 1.816 | 1.387 |

| Yield (t/ha) | 8.4 | 8.9 | 7.0 |

| Production (Mt) | 15.1 | 16.2 | 9.7 |

| Gp 1-3 variety proportion (%) | 41% | 47% | 51% |

| Milling wheat production (Mt) | 6.2 | 7.2 | 4.9 |

World supply

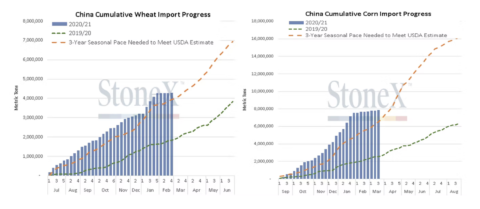

Despite high global wheat stocks, prices are still supported owing to concerns around soybean and maize supply and demand. The January 2021 USDA supply and demand estimates showed maize and soybean ending stocks are lowered, with US maize ending stocks at their lowest level since 2013/14 owing to reduced yields and a reduction in the harvested area. As maize can be used interchangeably in feed rations instead of wheat, tight stocks of this commodity impact the wheat market and wheat prices rose following the publication of the USDA report on 12th January.

Weather in key maize and soybean growing areas in South America has also impacted the supply and demand picture. Dryness in this major exporting region is likely to reduce production of these crops and as it stands, demand for both maize and soybeans is expected to exceed supply owing to strong demand from China (see Figure 2). A smaller Ukrainian maize crop, a major origin for UK importers, has also contributed to an increase in cereal prices globally and in the UK. The announcement of a wheat export tax in Russia, the world’s largest grain exporter, effective from 15th February, has increased the price of Russian wheat and lent further support to global grain prices. The tax will be introduced over 2 stages and sees wheat charged at €25.00 per tonne rising to €50.00 per tonne on 1st March. Barley and maize exports will also be taxed at €10.00 and €25.00 per tonne respectively.

Wheat market

With the UK at a significant wheat deficit owing to a meagre crop, wheat prices have risen to import parity – the price at which imports are as competitive as domestic origins. As such, global grain prices have a more direct impact on the UK wheat price, which now stands at its highest level in eight years.

Year-on-year, February quoted delivered breadmaking wheat prices (North West) are up £53.00/tonne (29%). From a longer-term perspective, quoted prices of breadmaking wheat are higher than at any point in the past five years (Figure 3). February 2021 same month delivery quotations (North West) stand at £239.00/tonne, £72.30 (43%) higher than the 5-year average for the equivalent quotation across 2016-2020. London feed wheat futures (LIFFE) also give an indication of the scale of the rise of the wheat price, standing at £207.60/tonne (nearby) on 29 January, the highest price since November 2012 (Figure 4).

Importantly, quotations have continued to rise throughout the season. At the beginning of September 2020, the forward quotation for February 2021 delivery stood at £213.50 per tonne, already an elevated level, but £25 less than today’s price for February delivery.

Summary

Global maize and soyabean tightness as well as political intervention affecting wheat imports has driven global cereal prices upwards. With the smallest domestic wheat crop since 1981 and as a significant wheat importer this season, the UK is particularly exposed to global price movements and the domestic wheat price is well above recent averages and the highest it has been since 2012.